Sometimes people just need a hand up. The question is — is there someone there to lend one? Lucky for her clients, Shamaila Arif from the Credit Counselling Society is this person. Her natural desire to go above and beyond earned her the 2016 Credit Counselling Canada Exceptional Service Award.

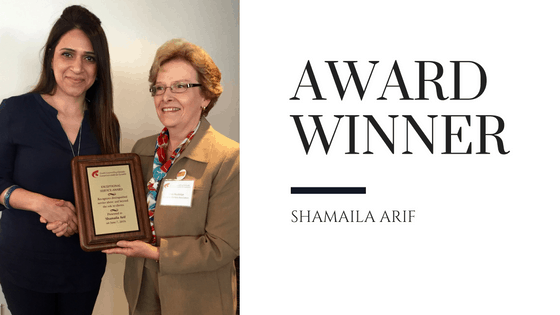

Linda Routledge (R) from the Canadian Bankers Association presents Shamaila Arif with the Credit Counselling Canada Exceptional Service Award.

Shamaila is an exemplary individual and the ideal role-model for those who aspire to become great credit counsellors. There is never a client whose situation, despite its challenges, will not be met with grace, patience, perseverance, and of course, skill. Her passion for helping people is clear.

Recently, one of the clients Shamaila counselled was suffering from cancer and going through chemotherapy treatment. She was in a fragile state. This client was a single senior citizen with no children. She had only a small fixed income, limited mobility, and was facing foreclosure on her home.

“Shamaila has been nothing but great! She’s quick and efficient and always available to answer any questions or concerns I had.”

Upon meeting the client, Shamaila recognized that the client had lost all hope and needed serious help. It also became clear that the challenges of the situation went far beyond the scope of a normal credit counselling duties. Thankfully, for this client, Shamaila is no ordinary credit counsellor. She is an exceptional credit counsellor, and what she did next was truly astounding.

Shamaila took it upon herself to assist the client in the following ways:

- She assisted the client with filling out and completing application forms for long-term disability.

- She contacted the Support for Daily Living Program and Central Registry and assisted the client with enrolling for this program which would allow her to be eligible for “senior’s housing”.

- She walked the client through the foreclosure process and referred the client to a realtor to assist with the sale of the client’s property, prior to foreclosure.

- Together with the client, she contacted the client’s creditors to help explain her health situation, and stop collection calls.

- She accompanied the client on a visit to the local social housing, allowing the client to see where she would be living.

Shamaila consistently gives her own personal time to ensure that all the clients she interacts with are provided exceptional credit counselling service and care.

“I met with Shamaila and she was helpful, calm, spoke in a language I understood and non-judgemental. She provided me with referrals and advised she could help but to keep her posted on my decision after my findings. Very pleasant person.”

If you need help with debt management, budgeting or general financial education, we can help you find a credit counsellor who can provide you exceptional credit counselling like Shamaila. Click here to find a credit counsellor near you.

Submitted by: Isaiah Chan